why is my debit card declined when i have money chase

9 hours agoThe reason customers call 800-518-0479 is to reach the Bank of America Customer Service department for problems like Report Fraud Card Declined Account Access Dispute a May 13 2021 If you lost or dont currently have your debit card you can contact Bank of America at 1-866-692-9374. Debit cards can be declined for a number of different reasons.

How To Know If My Debit Card Is Stolen And Money Is Also Transacted Quora

When you have your debit card declined but money in the bank is enough to complete the transaction incorrect PIN might be the reason.

. There are many reasons why a debit card is declined. It was even declined at a Chase ATM. Reasons Why Your Debit Card Declined.

The quickest way to do so is to contact your card issuer immediately. Rental car companies hotels and other merchants may put a hold on your card in order to ensure that your credit card doesnt get declined once they submit the final charge. Common reasons why your credit or debit card payment may fail include.

If you dont have Overdraft Protection or you dont have enough funds in your linked Chase savings account and you. If a card issuer declines a payment they may provide a reason through the use of a decline code CASH CHECKS AND GET YOUR MONEY IN MINUTES With the Ingo Money App cash paychecks business checks personal checksalmost any type of checkanytime anywhere Address and ZIP code do not match If youre still confused about why your customer. The bank could have blocked the card for fraud prevention the store may not accept your card type the card could be damaged or.

The payment could be larger than the maximum transaction allowed for your account or your debit card could be locked because you entered an incorrect PIN multiple times. Your card has a hold on it. Your credit card could get declined for a variety of reasons from the simple your credit card expired to the potentially more serious and complex potential fraud was detected.

And Canada at 1-215-845-By providing your mobile. Lets go into the reasons why your debit card can get declined and how to fix that. Ive had a Chase debit card for a long time and all of a sudden it started to get declined at stores like Frys Starbucks and Gamestop.

Please ensure that the name card number expiration date security code and statezip code match the account information that the card belongs to. First rep forwarded me to the transactions dept. Possible reasons why your Chase credit card was declined.

You dont have enough funds. This often happens when you enter an incorrect PIN at an ATM more than a few times. Even if you have money in your account your debit card can be declined for a number of reasons.

Really it would be very much irritating and out of frustration temper may be lost. Choose NO the transaction will be declined and you wont be charged a fee Choose YES we may pay the overdraft transaction at our discretion based on your account history the deposits you make and the transaction amount. Why is my Chase debit card being declined.

If your card has been frozen due to a case of mistaken fraud detection you can call the credit card company to verify that youve authorized the online transaction in question. Unlike a credit card when you make a purchase with your debit card the amount is withdrawn from the available balance in your checking account. Not having sufficient funds in the account is one of the most common reasons why your debit card can get declined.

I didnt receive any kind of alerts notifying me that my card was locked down for any reason and I have plenty of funds in my account so I thought that there might. Probably understanding how the transaction is being processed may. Suspected fraud is one of the most common reasons for your card to be declined.

Its possible for a hold to stay on your card even after youve paid your balance. Debit card is declined though theres money in the account. Your debit card can be declined for various reasons including going near or over the limit the card issuer suspects the card is being used fraudulently it is a new card that is not activated youre using it outside of the typical location or it is expired just to name a few.

Walmart said it was on a finance hold with Chase. Even though you may have enough money in your checking account there is a difference between your bank account balance and your available funds. Insufficient funds are the main reason that debit cards are declined.

Failed 3D secure identification. Double-check that your card details are correct and that youve used the right postal or zip code on your billing address. This is the most common cause of a debit card being declined and one that you can easily avoid by keeping careful track of your spending money.

Either way you should call Fulton Bank at 800-385-8664 and ask a customer service representative about the issue. Unless you have overdraft protection most banks will not allow you to make a purchase or withdrawal that goes beyond your available balance. Having insufficient funds means that there isnt enough money in your account to cover your purchase.

The cardholder has not yet activated. The charge is larger than what you usually would put on your card. If you do not keep consistent track of your spending you may run out of cash and not be aware of it.

Your debit card has been locked by your issuing institution. The payment is larger than the maximum transaction allowed for your account. This can happen when youre not tracking money going in or out of your account.

The account used for this transaction is flagged as a fraudcaution account. Card information entered incorrectly. The most common cause of a declined debit card is insufficient funds in your bank account.

Therefore if you dont have enough money in your account to cover the transaction you may see the card declined for insufficient funds. The payment amount exceeds your daily spending limit. Heres why your card may have been rejectedand what you can do to prevent it from happening again.

Either way you should call Fulton Bank at 800-385-8664 and ask a customer service representative about the issue. Your bank may have blocked you from making payments to FanDuel. Why at all it happens.

The account used for the attempted transaction has a negative credit rating. Answer 1 of 27. To ensure that your card is still valid check the expiration date on the front of your card.

Below are a few reasons why your attempt to deposit using a Credit or Debit Card may have been declined along with some some solutions.

Using Debit Card As Credit Credit Com

12 Reasons Your Debit Card Declined How To Fix

Illinois Ides Unemployment Debit Card Hasn T Arrived Or Can T Access Funds According To People Who Filed And Were Approved For Benefits Abc7 Chicago

Unexpected Cash App Debit Card Could Be A Sophisticated Scam Money Matters Cleveland Com

Mobile Banking Made Easy With Go2bank Green Dot

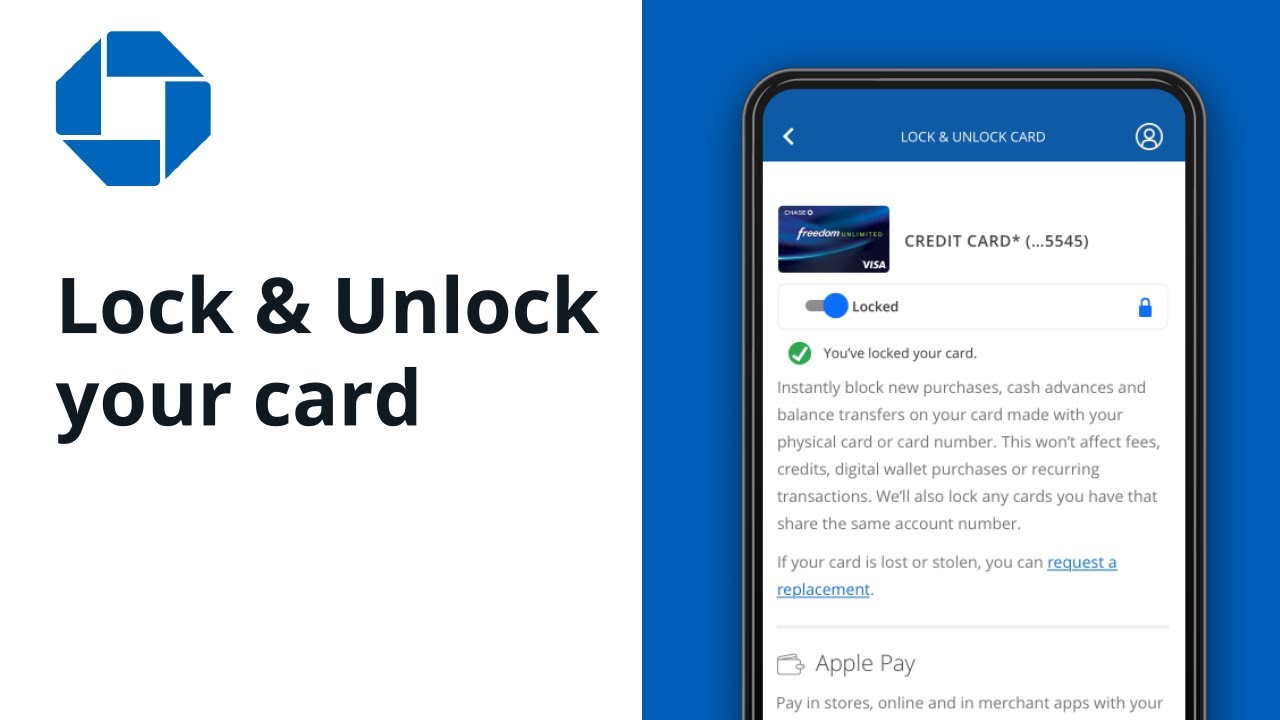

How To Lock Unlock Your Credit Or Debit Card Chase Mobile App Youtube

Chase Debit Card Foreign Transaction Fee Your Complete Guide

New Chase Account Helps Kids Develop Healthy Saving And Spending Habits

Lock Debit Card Support Center

Why Was My Debit Card Declined When I Have Money And How To Fix It Smart Mom Hq

Why Is My Debit Card Being Declined When I Have Money In My Account

Michigan Negotiates New Unemployment Debit Card Contract To Save Taxpayer Money Consumer Fees Mlive Com

Why Is My Debit Card Declined When I Have Money How To Fix Deactivation Tightfist Finance

40 Creative And Beautiful Credit Card Designs Hongkiat Credit Card Design Debit Card Design Gift Card Design

12 Reasons Your Debit Card Declined How To Fix

How Visa Debit Works In The Us Vs Canada Helcim

Use Apple Pay Cash With A Debit Card To Avoid A 3 Credit Card Transaction Fee Appleinsider

Venmo Officially Launches Its Own Mastercard Branded Debit Card Techcrunch